Internal Rate of Return

What’s internal rate of return (IRR) ?

To assess the possible profitability of investments, financial researchers utilise the internal rate of return (IRR). The IRR is the discount rate that brings all cash flows’ net present values (NPV) to zero in a discounted cash flow analysis.

The NPV and IRR calculations both use the same formula. Remember that the full financial worth of the project is not accurately reflected by the IRR. The annual return is what brings the NPV to a zero sign.

Generally speaking, the more desirable an investment is to make, the greater the internal rate of return. IRR can be used to rate a variety of potential investments or projects on a pretty even basis because it is consistent for investments of various types. Generally speaking, the investment with the highest IRR would be regarded as the best when comparing options with other similar attributes.

Notes-

The internal rate of return is the expected yearly rate of growth from an investment (IRR).

IRR calculates it by setting net present value (NPV) to zero, just like NPV.

The ultimate objective of IRR is to determine the discount rate that will bring the present value of the total annual nominal cash inflows to the same amount as the original net cash outlay for the investment.

IRR is the best tool for examining capital budgeting projects in order to comprehend and contrast probable annual rates of return over time.

IRR can assist investors in calculating the investment return of various assets, in addition to being utilised by businesses to choose which capital projects to deploy.

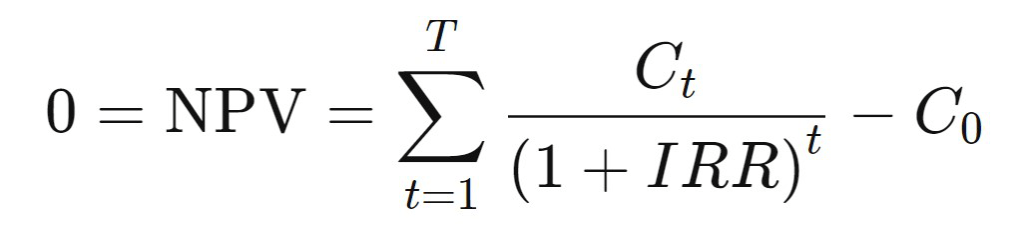

Formula and Calculation for IRR

Where,

Ct = Net cash inflow during the time period t

C0 = Initial investment costs in total

IRR = Internal rate of return

T = The length of time periods

How to Calculate IRR

- To find the discount rate, or IRR, one would use the formula, setting NPV equal to zero.

- Due to the fact that it represents an outflow, the initial investment is always negative.

- Depending on the projected future benefits or capital infusion needs, each succeeding cash flow may be either positive or negative.

- IRR must be calculated iteratively through trial and error or by using software designed to calculate IRR due to the nature of the formula, which makes it difficult to calculate analytically (e.g., using Excel).

Understanding IRR

The ultimate objective of IRR is to determine the discount rate that will bring the present value of the total annual nominal cash inflows to the same amount as the original net cash outlay for the investment. There are a number of ways to determine an expected return, but IRR is frequently the best option for evaluating the possible return of a new project that a firm is thinking about starting.

Consider IRR to be the annual growth rate that is anticipated from an investment. Consequently, it may be most comparable to a compound annual growth rate (CAGR). Actually, a return on an investment won’t always be the same year after year. A given investment’s actual rate of return will typically be different from its estimated IRR.

What Is IRR Used for?

Comparing the profitability of starting new operations with that of expanding current operations is a common scenario for IRR in capital planning. When determining whether to build a new farm or renovate and expand an existing one, for instance, an energy firm may consider IRR.

Despite the fact that both projects have the potential to raise the company’s value, it is likely that one will be the more logical decision based on IRR. It should be noted that IRR frequently falls short for longer-term projects with variable discount rates since it does not take shifting discount rates into account.

A company’s stock buyback program can be evaluated using IRR. The research must demonstrate that the company’s own stock is a better investment—that is, has a higher IRR—than any other use of the cash, such as developing additional stores or acquiring other businesses, if the corporation invests significant funding to share repurchase.

When making financial decisions, people can also use IRR. For instance, they might compare the premiums and death benefits of various insurance policies. Policies with the same premiums and a high IRR are often regarded as being significantly more desirable.

Keep in mind that the IRR for life insurance is sometimes over 1,000% during the first few years of the term. It then gradually gets smaller. This IRR is very high in the early phases of the policy because your beneficiaries would still receive a lump sum benefit even if you just paid one monthly premium payment.

IRR is frequently used to evaluate investment returns. The advertised return will often be based on the assumption that any interest or cash dividends will be reinvested in the investment. What if you require dividend payments as income but don’t want to reinvest them? And are dividends paid out or kept in cash if it is not anticipated that they would be reinvested? What rate of return on the money is anticipated? IRR and other assumptions are crucial when dealing with complex cash flows found in securities like annuities.

The money-weighted rate of return on an investment is calculated using the IRR formula (MWRR). By taking into account all variations in cash flows over the course of the investment period, including sales proceeds, the MWRR aids in calculating the rate of return required to start with the initial investment amount.

IRR vs. Compound Annual Growth Rate

The CAGR calculates the yearly return on investment over time. The CAGR normally employs simply a beginning and ending value to generate an expected annual rate of return, but the IRR typically uses both.

IRR differs in that it takes into account numerous periodic cash flows, reflecting the fact that when it comes to investments, cash inflows and outflows frequently happen continuously. Another difference is that CAGR is straightforward enough to be calculated.

IRR vs. Return on Investment (ROI)

When deciding how much money to allocate for capital expenditures, businesses and analysts may additionally consider the return on investment (ROI). ROI informs a potential investor of the investment’s overall growth from beginning to end. The rate of return is not annual. The annual growth rate is disclosed to the investor by the IRR. Over the course of a year, the two values would typically be the same, but not for longer periods of time.

ROI is the overall percentage growth or decline of an investment. It is determined by dividing the initial value by the difference between the present or anticipated future value and the beginning value, then multiplying the result by 100.

For almost every activity where a financial expenditure has been made and an outcome can be quantified, ROI statistics may be produced; nevertheless, ROI is not always the most useful for long time horizons. It has limits in capital budgeting as well because the emphasis there is frequently on recurring cash flows and returns.

What Does Internal Rate of Return Mean?

A financial indicator used to evaluate the attractiveness of a certain investment opportunity is the internal rate of return (IRR). When you calculate the internal rate of return (IRR) for an investment, you are essentially predicting the rate of return of that investment after taking into consideration all of its anticipated cash flows and the time value of money. The investment with the highest IRR, if it exceeds the investor’s minimum threshold, would be chosen from a group of alternative investments by the investor. IRR’s primary flaw is that it relies so heavily on predictions of future cash flows, which are notoriously difficult to make.

What Is a Good Internal Rate of Return?

The opportunity cost of the investor as well as the cost of capital will determine whether an IRR is favourable or unfavourable. For instance, a real estate investor might pursue a project with a 25% IRR if comparable other real estate investments offer a return of, say, 20% or lower. This comparison, however implies that the risk and work needed in making these challenging investments are about the same. The investor might gladly accept a project with a lower IRR if it offers significantly less risky or less time-consuming. But generally speaking, if everything else is equal, a higher IRR is preferable than a lower one.

Also Read – Mutual Fund Expense Ratio

Also Read – Mutual Fund Return Calculator